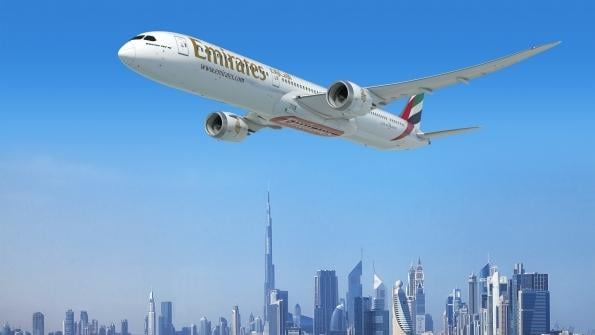

Clark Explains 787 Order, Emirates’ Stance On Open Skies

Emirates’ order for 40 Boeing 787-10s should not surprise anyone, because it fits naturally into the airline’s fleet plans, President Tim Clark told Aviation Daily at the Dubai Airshow. The carrier in 2007 placed an order for 70 Airbus A350s, which it canceled in 2014. But since then, it has ordered...

Subscription Required

This content requires a subscription to one of the Aviation Week Intelligence Network (AWIN) bundles.

Schedule a demo today to find out how you can access this content and similar content related to your area of the global aviation industry.

Already an AWIN subscriber? Login

Did you know? Aviation Week has won top honors multiple times in the Jesse H. Neal National Business Journalism Awards, the business-to-business media equivalent of the Pulitzer Prizes.