This article is published in Air Transport World, part of Aviation Week Intelligence Network (AWIN), and is complimentary through May 23, 2024. For information on becoming an AWIN Member to access more content like this, click here.

Can a budget carrier that is laser-focused on profitability be among those airlines that lead aviation into the age of hydrogen? UK-based LCC easyJet believes it can help set the pace and is working with aircraft and engine manufacturers to explore the opportunities and challenges for hydrogen in commercial aviation.

“We need to change the way we think about this, from looking at the fuel to the energy and the energy ecosystem,” easyJet head of net zero Lahiru Ranasinghe said. The fundamental question, he said, is what is the cleanest and most efficient source of energy for a given application? “We are saying it’s really horses for courses.”

Electrification will come at the small end of the aircraft market while hydrogen comes into its own in fuel-cell powertrains for regional aircraft, Ranasinghe said.

“For the kind of aircraft we operate, you’re really looking at hydrogen combustion. We see SAF [sustainable aviation fuel] as the mainstay for the widebody market,” he said.

EasyJet’s view on SAF is key to its exploration of hydrogen.

“We see hydrogen as very complementary with SAF for the long-term decarbonization of this industry,” Ranasinghe said. But a massive proportion of the SAF needed to decarbonize aviation will have to come from power-to-liquid fuels, which require green hydrogen and carbon capture.

“All the work we’ve done with our partners indicates that the direct use of hydrogen in liquid form, from an energy ecosystem perspective, is significantly more efficient than using it as a component of a power-to-liquid SAF,” he said.

Additionally, as narrowbody operators move toward hydrogen, this will ease the pressure on SAF supply chains and allow more of that fuel to be freed up for the widebody and long-haul market, he said, helping decarbonize the whole aviation sector.

Ranasinghe acknowledges it would be easier for aviation to say SAF is the solution because it uses the same suppliers and pipelines as fossil jet fuel. This compares with the significant challenges and investment required to deliver liquid hydrogen to aircraft.

“But if we look at the end-to-end ecosystem, the power-to-liquid SAF requirement will require a massive renewable energy infrastructure investment downstream,” he said. “What we might have to say is the UK has to be planted entirely with wind turbines to be able to generate that additional power.”

Hydrogen-powered aircraft are expected to have a more limited range than today’s kerosene-fueled airliners because of the size and weight of cryogenic liquid hydrogen tanks. Is a large airline prepared to operate a distinct subfleet just so it can use hydrogen? EasyJet, after all, operates more than 300 aircraft of one type, the Airbus A320 family—“one of the most boring airlines for a plane spotter because you basically have small, medium and large of the same white and orange aircraft,” Ranasinghe joked.

“The simple answer is we don’t like complexity, but we also don’t see a way around it because we have decarbonization targets as an airline and an industry that are going to make our business a bit more difficult,” he noted.

“We’re not going to flip the fleet in a couple of years,” Ranasinghe emphasized. “We use our aircraft for a little over 20 years. It will take some time from the first aircraft entering the fleet to having those aircraft as the majority of the fleet. We will have subfleets in that period.”

But easyJet has a base structure across Europe. Some, like London Gatwick, are massive. Others have five or six aircraft. “We have the capability to ring-fence the localized operations in a way that you have a hydrogen-powered subfleet confined to a single airport to start, and then grow from there,” he pointed out.

“We see plenty of challenges of hydrogen, but one of the opportunities we see in the early days of the hydrogen transition is that we could have the ability to tanker in hydrogen and do a lot of our shorter sectors there and back with refueling only at the base.”

This would avoid the need to have hydrogen infrastructure all over Europe.

“We just need to have it at that base, which then drives localized demand for hydrogen,” he said. “We do have to figure out the diversion factor. When you have to divert an aircraft and refuel to get it out of there, what happens then? That to us is a bigger question in the early days than having infrastructure everywhere.”

INDUSTRY PARTNERS

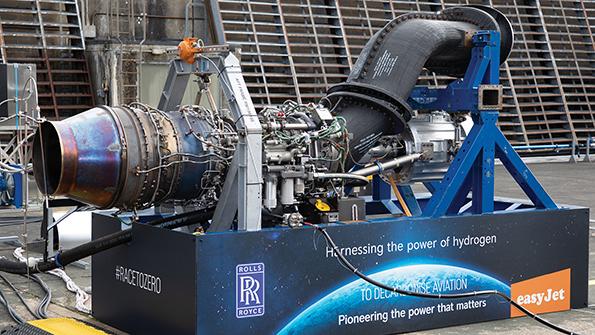

EasyJet is exploring hydrogen through partnerships with Airbus, Rolls-Royce, Cranfield Aerospace Solutions and GKN Aerospace. “We are trying to work together to de-risk and accelerate this transition because what we are looking for is not Concorde; it’s a bus that can fly six sectors a day, day in, day out, for 20 years,” Ranasinghe said.

“We are providing our operational and commercial expertise and at the same time gaining knowledge and understanding of these systems that are completely alien to us.”

At the same time, the cooperation is building capability at easyJet’s industry partners.

“We see this as a necessity for the industry. We’ve got to hit net zero by 2050 and stay net zero at worst. We need to be going toward zero carbon emissions, full stop,” Ranasinghe said. Hydrogen emits no carbon, unlike SAF, which achieves CO2 reductions only on a life-cycle basis.

Ranasinghe posed the question: “How feasible is it to be cycling carbon through the atmosphere as opposed to being able to not emit carbon at all? We will come under more and more scrutiny as an industry. Maybe not today or tomorrow, but as the rest of the world decarbonizes.”