Opinion: The Battle Over In-flight Wi-Fi Heats up

Last year, we covered the advent of Low-Earth-Orbit (LEO) satellite networks in business aircraft, like Starlink and OneWeb, and their latency advantages over traditional Geostationary (GEO) satellite networks. The choices in connectivity can be overwhelming to business aviation users who just want the Wi-Fi to “work” but beaming data to a fast-moving aircraft across Earth and space…is a complicated feat.

While upload and download bandwidth are important, latency, network load, number of beams, coverage and security all play a role in the best experience for aircraft passengers. Bandwidth is the amount of capacity that is available for data to be transferred by devices across a network in a given area, but latency is a measurement of roundtrip delays of data transmitted to and from devices across the network.

In layman’s terms, think of a network as data traveling through a pipe: bandwidth represents the width of the pipe (the volume that can move through the network) and latency as the speed at which that data travels through the pipe. There’s a lot more to these technologies to consider including throughput, the transferring to different ground stations, satellites and more, but for basic comparison, bandwidth and latency are key. Air-to-ground (ATG) and LEO networks will always win the latency battle over GEO networks because no technology can overcome the speed of light. The closer a beam is to the target, the less distance the data needs to travel.

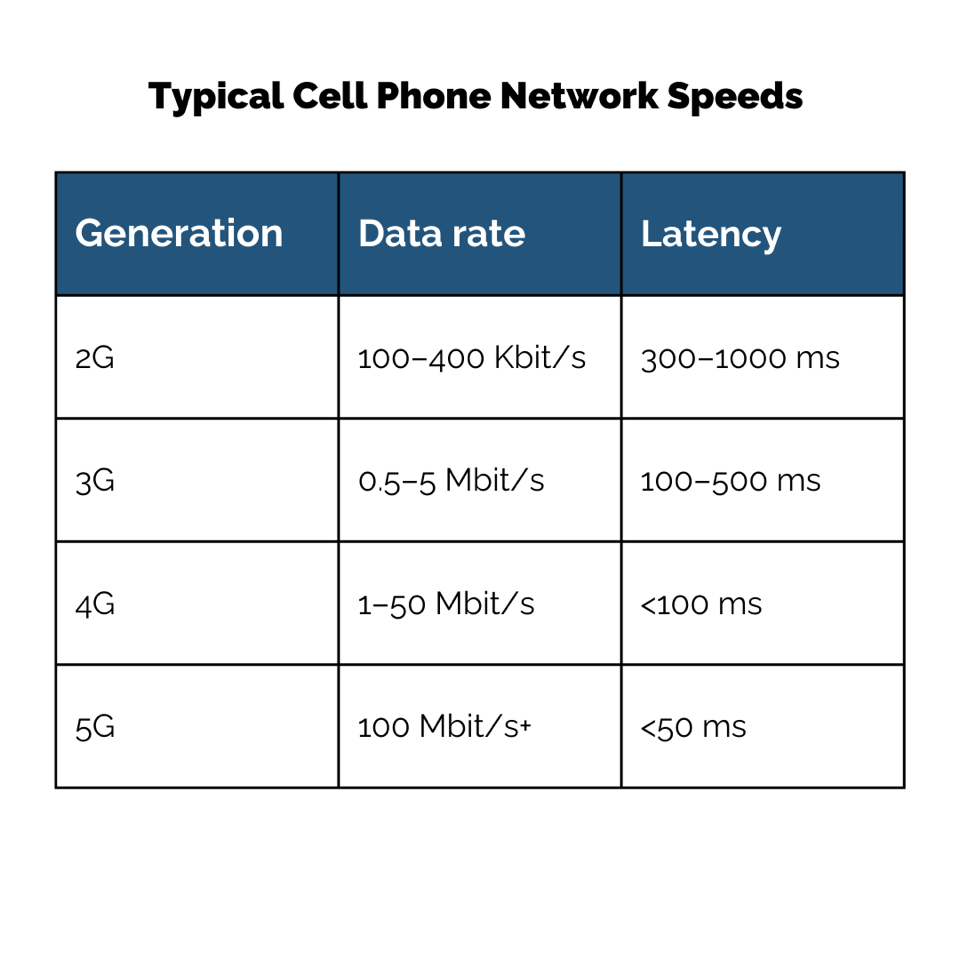

On a cell phone, anyone who’s been in a 3G area after getting used to 5G coverage has experienced stark differences in latency and bandwidth. Modern applications are typically designed for low-latency environments, like offices and 4G/5G networks. Video conferencing, live document editing and streaming speeds affect the passengers in the back of the aircraft, but as cockpits evolve to provide crew with weather data and the transmitting of flight data to the ground, the need for fast data, high-bandwidth transfer is ever expanding.

For years, Gogo has been the undisputed market leader in the domestic US. Gogo generally wins users operating primarily in the U.S. as their antennas can be equipped on small aircraft (GEO satellite antennas are too large for most light and turboprop aircraft), and in the past, they had provided more bandwidth and lower latency than satellite networks.

Gogo has equipped almost 7,000 aircraft so far. According to ARGUS, there are 24,939 active jet and turboprop business aircraft year to date in the US, of which 16,948 are jets. This puts Gogo at least 28% market penetration today. Outside the US, there were 23,668 active business jets in 2023.

Gogo has completed multiple network overhauls over the years, and its much-anticipated 5G deployment is expected in mid-2024. It had originally planned to deploy this upgrade in 2021, but due to COVID chip shortages and a recent design flaw, the rollout has been significantly delayed. Once launched, the 5G service is expected to boast peak speeds of up to 80 megabits per second (Mbps) and 25 Mbps on average, contingent on live network testing next year. It’s current 4G network has average download speeds of 3-9.3 Mbps, depending on the equipment installed.

Long awaited ATG up-start SmartSky is making moves by signing large fleet operators, like FlyExclusive and Volato to its system. SmartSky CEO David Helfgott highlights that its network is unique because each aircraft receives its own individual data “beam” unlike Gogo’s 4G network where users may share a beam, which could lower bandwidth. He highlights that this provides exceptional coverage in congested locations like Teterboro and South Florida, and better security.

The firm is aggressively targeting existing users of Gogo by offering up to $50,000 in rebates when they trade in their Gogo systems for a SmartSky install. The two rivals also have been in the courts battling over patent infringements. SmartSky's ground network is running a mix of 5G and LTE technologies, giving it actual measured peak download speeds of more than 20 Mbps and uploads of over 18 Mbps.

While the ATG battle rages on land, its dominance ends over water where connectivity is not available. Viasat, and others who use a GEO satellite array, may not be able to compete with ATG latencies but have greatly enhanced their network by launching Ka-band satellites in addition to their Ku-band constellation, boasting typical download speeds of 30 Mbps or more and peaks of up to 90 Mbps, and global availability. Viasat’s anticipated Ka-band extension of this network with the Viasat-3 satellite launch in May suffered an issue in deploying its antenna and may never be commercially viable, which could result in a $420 million insurance total loss claim.

LEO satellites are entering the space to offer both high bandwidth and low latency across the globe. Starlink’s aviation product was installed on JSX’s fleet in 2023 and the operator plans to roll out the product on its entire fleet this year. Flexjet has also recently announced the installation of Starlink on its fleet of Gulfstream 650s.

Gogo announced plans to integrate LEO services from OneWeb into its existing equipment in the future, providing a combined ATG and LEO service in one system. Plus, its Avance equipment has been designed to be upgraded remotely, removing the need for customers to “rip and replace” hardware in the future. Other LEO providers like Telesat Lightspeed are also advertising aviation solutions as they launch new constellations but have not specifically targeted business aviation to date.

Network congestion, and the regulation of objects in space, will be a key consideration in the future as more users get online. While systems like Gogo and SmartSky are focused solely on business jets, GEO and LEO providers are offering their services to everyone, including those on the ground and sea. Contention, the sharing of a network between air and terrestrial internet users, could cause significant degradations in service over time.

Gogo President Sergio Aguirre points out that Gogo is the longest provider to this industry, giving it an advantage in their network design, as well us an intimate understanding of the needs of corporate flight departments. When testing out new platforms, “Users may have a great experience on a test flight, but they need to be aware that these demos may not represent the real experience over a loaded network,” he says.

Long-term, the key to success for any of these providers is securing relationships with aircraft manufacturers and repair shops, ensuring timely repairs and installs, and Gogo certainly has first mover advantage here. New buyers are often presented with standard options when selecting delivery features on their aircraft, and repair shops are accustomed to installing systems they already understand. SmartSky executives say, however, “all you have to do is ask” and that they have great relationships across the industry to support installers and repair organizations.

All this competition in connectivity is great news for business jet owners and will ultimately lead to more options and better prices overall. Plus, as the industry sees the adoption of flight data monitoring, live maintenance tracking and other safety enhancements, business jet operators should be thinking about the needs of the entire aircraft when choosing their connectivity equipment, not just streaming Netflix.

Jessie Naor is the author of Sky Strategy, an opinion column, in BCA and CEO of FlyVizor, an aviation M&A advisory and business consulting firm. She is a former founder and president of GrandView Aviation.

Editor's Note: This story has been corrected to reflect SmartSky's ground network technologies and download and upload speeds.