Business Aircraft Post-Pandemic Mods, Part 2

In an historically tight market for pre-owned aircraft, business jet owners are seeking a range of modifications and upgrades to their existing aircraft as they anticipate the end of the Covid-19 pandemic, MRO executives tell BCA.

Thomas Chatfield, CEO of Vancouver-based Camber Aviation Management, a completion management firm catering to the large-cabin business jet market, reported that, at this stage of the Covid-19 pandemic, a considerable amount of cabin refurbishment activity is taking place, particularly among aircraft approaching their first major checks—about 10-12 years for a private jet. And while cabin refurbishments range from re-upholstery to major upgrades of communication and entertainment systems, he noted that major changes to galleys are also happening.

“Operators want the ability to prepare and cook food inflight, rather than just heating something in a microwave,” said Chatfield. “We are seeing this trend among operators of Global Expresses, Gulfstreams and Falcons. The latest kitchen technology, on the ground, is being applied to business aircraft.”

Chatfield said that video conferencing is another trending upgrade, said Chatfield. “That’s the next logical step beyond email, texting and voice, and it is starting right now,” he stressed.

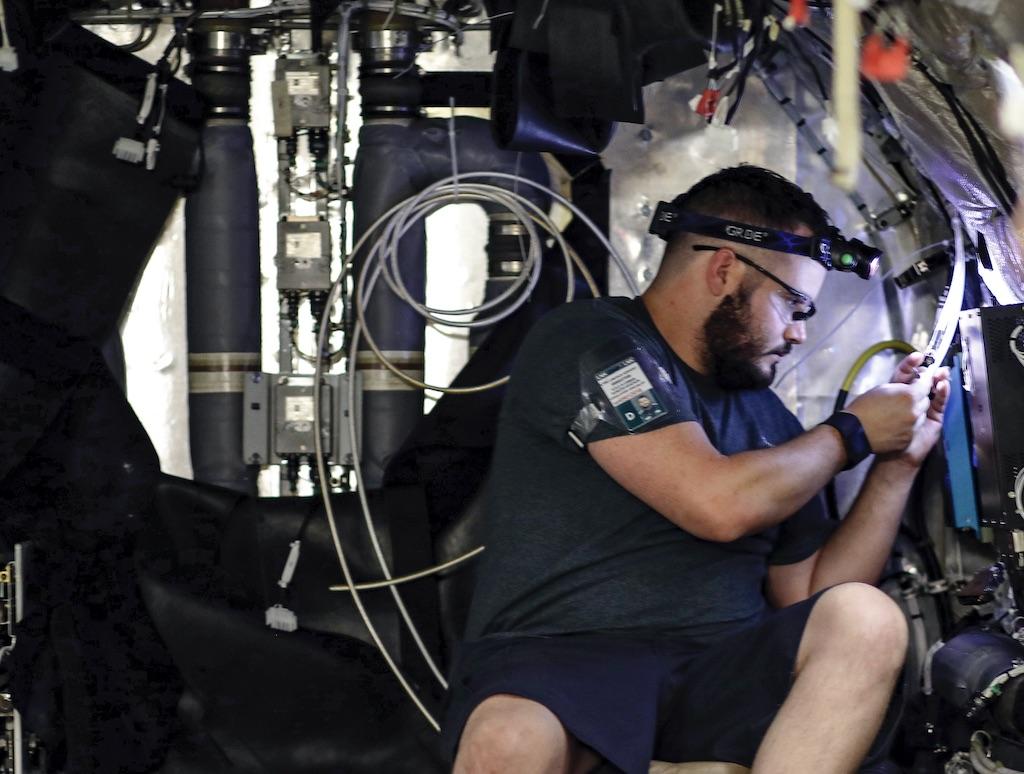

Asked if the pandemic has directly led to demand for any specific kinds of modifications, Chatfield said that three are especially representative of post-COVID flying. The first pertains to air filtration systems. “Depending on the aircraft’s age, it could involve simply replacing the filters and cleaning the ducting, or installing antimicrobial systems,” he said. “Because of the pandemic, antimicrobial air purification systems will become popular and in demand.”

The second modification in demand addresses repair and replacement of upholstery and cabin finishes, such as wood trim. During the worst of the pandemic, cleaning solutions were heavily applied to almost every surface in the cabin including the upholstery and the trim. “However repeated applications of cleaning solutions can degrade and damage upholstery and wood finishes. At the same time, the aging process takes its toll,” said Chatfield.

The third cabin upgrade Chatfield mentioned is the installation of anti-microbial ultraviolet lamps. “When the aircraft discharges passengers and the door is closed, the UV lamps, which work on a timer, are activated to disinfect the cabin. Depending on the time set, they automatically shut off,” he said.

Another trend that Chatfield has observed is that people new to business aviation are entering the market by acquiring pre-owned aircraft and ordering upgrades and modification work. “I believe we will see more of this by corporate, private and charter operators,” he remarked. “That will generate more maintenance events.”

Independent and OEM-operated MROs are reporting heavy bookings and work orders in line with what industry experts have predicted.

Refurbishment Market Stays Strong

“The business aircraft refurbishment market got very strong, starting in mid-2020, and it has not changed going into the post-pandemic period,” said Phil Stearns, director of sales and marketing for Greenville, South Carolina-based Stevens Aerospace and Defense Systems. “It has essentially remained strong with the primary focus on paint and interior work.”

Stearns called the past 12 months “a very solid time for refurbishments,” specifically citing requests for connectivity and customized interiors by operators of small and mid-size jets, as well as turboprops. “Customized interiors used to be mainly on large-cabin jets, but now, everybody wants one,” he said. “Customers want something more like what they would have in their homes and cars, such as a favorite color. We are, in fact, getting a lot of orders for LED lighting in different colors.”

Over the next 18 months, Stevens expects a considerable amount of avionics work from Mexican operators for compliance with new mandates from Mexico’s Administración Federal de Aviación (AFAC). According to Stearns, this will include ADS-B Out and flight data recorder installations. “All four of our locations have AFAC authority to do the work, and we are working with a number of Mexican operators to comply,” he said.

Michael Parrish, vice-president, sales for Elliott Aviation in Moline, Illinois, said that the high demand in the used aircraft market has been the most significant driver for modifications and other MRO work. “A larger proportion of the buyers that we see in the light and midsized jet markets are first-time buyers,” he explained. “As inventories in the used market shrink, fewer airplanes are available, which means the used aircraft that are selling might not fit the buyer’s immediate needs, so they need to make modifications or upgrades.”

Parrish reported that Elliott Aviation is fielding many requests for everything from performance-based modifications, such as winglets and engine upgrades, to such purely aesthetic enhancements as hand-tufted carpets. “Across the board, we are seeing an increase in demand for updating outdated lighting systems with LED mood lighting, like Prizm cabin lighting,” he said.

Parrish added that avionics upgrades that continue to remain popular are the Garmin G1000 NXi for the Beechcraft King Air, and the G5000 for the Citation Excel/XLS and Beechjet 400A/Hawker 400XP. He also noted a rise in demand for the Collins Pro Line Fusion avionics system for the Challenger 604, Citation CJ1+/CJ2+/CJ3, and Garmin G600 upgrades for the King Air 90s.

“I will also mention that cabin Wi-Fi is essential,” said Parrish. “The Gogo Avance system provide faster speeds than the older air-to-ground systems and are in high demand in every market segment,” says Parrish.

In-Flight Entertainment Demand

Lincoln, Nebraska-based Duncan Aviation has also seen a bow wave of requests for modifications, according to Nate Klenke, sales manager for modifications. “There are more pre-buying inspections, along with growing demand for interior and (some) flight deck upgrades,” he explained. “That’s typical of when an aircraft changes ownership, and it’s now at the point where capacity to do this work is being consumed.”

Specifically, said Klenke, customers are requesting up to date in-flight entertainment and cabin management systems, along with new color change lighting. The avionics upgrades have focused mainly on new, more capable flat panel display systems to replace old CRT screens.

“There’s still a lot of interest, but it is being driven mainly due to obsolescence—older systems that are now prone to frequent failure and are getting more difficult to support,” he said. “Panel upgrades in the cockpit from all of the major avionics providers—Collins, Garmin, Honeywell and Universal—are in demand, and are being completed across Bombardier, Citation, and Dassault models.”

According to Brian Adams, vice president for aftermarket innovation at Textron Aviation, state-of-the-art “connectivity still leads the way” and has become almost standard equipment for many fleet customers. “Interior upgrades complement this connectivity install as customers can totally redefine the passenger experience,” he remarked.

Adams also pointed out that as travel increases and major airports become more congested, there is a renewed interest in evolving airspace components, including Future Air Navigation System 1/A (FANS 1/A) and controller pilot data link communications (CPDLC). “Customers are interested in staying compliant with mandates, as well as improving operational efficiency and decreasing pilot workload,” he said. “There are many new avionics options available for Textron Aviation airframes that include these new features through either modular solutions or complete panel retrofits.”

Embraer reported similar trends in the business jet refurbishment market, largely propelled by used aircraft transactions. “Roughly two-thirds of our current flying fleet of executive jets are from the Phenom 100/300 family, so naturally the used aircraft market is hotter in their segments,” said Marsha Woelber, Embraer Service and Support head Of worldwide executive jets customer support and aftermarket sales. “But we are also seeing a significant movement in the Legacy 600/650 and Legacy 450/500 markets as well,” she added. “However, similar to the pre-pandemic scenario, Embraer’s best-selling aftermarket solutions remain for the Phenom 300 and Legacy 450/500.”

Woelber said interest in maintenance and modifications was steady through 2020, and has remained so far this year. This enabled the OEM to maintain its service center staffing levels without impact. “We expect demand to accelerate in the months ahead with the high level of activity in the used market, especially with first-time buyers,” she said. “We expect these customers to turn to us as the OEM as their first choice for maintenance and modifications.”

Sergio Cunha, Embraer Technical Services and Support vice president, noted that while demand for avionics upgrades has decreased since the wave of modifications to meet mandates in 2018-19, Embraer continues to include the most desired features in its modifications portfolio. Here, he said, the focus is particularly on those modifications that bring new safety features and operational performance enhancements such as predictive windshear detection, Synthetic Vision Guidance System (SVGS), Synthetic Vision System (SVS), Surface Management System (SMS), and Runway Overrun Awareness and Alerting System (ROAAS).

Avionics upgrades are mostly being driven by global airspace modernization efforts, said Craig Bries, vice President and general manager for avionics service and support with Collins Aerospace.

“ADS-B mandates were the focus back in 2019, but other new airspace technologies such as Performance-Based Navigation procedures and other forms of communication between pilots and air traffic control, including CPDLC are becoming the focus,” he explained. “These tools enable more efficient routing through airspace, easier/more accurate communications with ATC, and help to reduce fuel usage overall—all contributing to more sustainability within this segment.”

See Business Aircraft Post-Pandemic Mods, Part 1: https://aviationweek.com/business-aviation/maintenance-training/busines…