Competition for cockpit-focused L-band satellite communications (satcom) has heated up with Inmarsat’s recent announcement of a major “Elera” network upgrade even as avionics manufacturers continue developing first products for rival Iridium’s new Certus offering.

While Ka-band (26.5-40 GHz) is known for in-flight connectivity to aircraft cabins, L-Band (1-2 GHz) is the host band for aeronautical communication functions including safety-critical Aeronautical Mobile (Route) Service air traffic services.

Iridium launched Certus, a high-speed, internet protocol-based satcom service operating in the L-band, with the deployment of its new-generation Iridium Next low-Earth orbit (LEO) satellites in early 2019. The service initially became available for the land-mobile and maritime markets.

Plans call for phasing in Certus service classes for business and commercial aviation, beginning with Certus 350, capable of 352 kbps data speed to support inflight applications such as flight data recorder streaming. Certus 700, capable of 704 kbps (352 kbps transmit; 704 kbps receive) presents competition for Inmarsat’s SwiftBroadband service at 432 kbps per channel for up to four channels per aircraft. Iridium’s legacy service, which Iridium Next satellites continue to support, provides 2.4 kbps.

Major value-added manufacturers (VAMs) for Certus aviation terminals continue working toward certification of their respective products, said Tim Last, Iridium vice president and general manager, Americas. Iridium lists 10 VAMs that are developing Certus 700, 200 or 100 systems for aviation: Thales, Collins Aerospace, Honeywell Aerospace, Skytrac, Satcom Direct, Flylogix, Telespazio, Blue Sky Network, Atmosphere and Flyht Aerospace Solutions.

Certus 100 and 200, with data speeds up to 88 and 176 kbps, respectively, are optimized for host platforms with size, weight and power limitations such as uncrewed air systems.

“We finished deploying our current-generation network about two years ago,” Last told ShowNews. “We did deploy maritime and land solutions first, but we’ve been working diligently with a number of aviation partners on solutions for the aviation market. The big avionics companies that we assigned out as Certus partners are still knee-deep in development in most cases for their products, and obviously that’s not been helped by the last year and a half of the [COVID-19] pandemic, which has particularly decimated commercial transport.”

Specifically, Last mentioned products advanced by Thales, Honeywell and Collins Aerospace. On Aug. 12, Honeywell said that its Aspire 150 and 350 satcom systems designed to use Certus should be certified this year, and it declared that Aspire systems will be the first to demonstrate connectivity up to 700 kbps via Certus.

Collins is developing the IRT-NX system for Certus, including a satcom data unit, satellite configuration module and either active low-gain antenna or high-gain antenna. A high-gain antenna allows more of the transmitted power to be sent to a receiver; it accommodates higher data rates but requires more accurate pointing. A low-gain antenna transmits and receives in all directions but supports lower data rates. Thales is developing FlytLINK, a series of systems using small high-, intermediate- and low-gain antennas.

“The good news is that none of those programs were fatally wounded,” because of the pandemic, Last said. “All of the products, particularly those with Honeywell, Collins [and] Thales—which are the companies that are doing Certus 200, 350 or 700 products—are still well underway. None of them are yet commercially available fully in the market. All of those companies have been ‘on air’ with their products, and we’re looking forward over the course of about the next six to nine months seeing those three companies actually on aircraft in various stages of testing.”

Iridium recently received approvals from standards organizations RTCA and the European Organization for Civil Aviation Equipment (Eurocae) to offer Certus as a safety-critical service that supports FANS 1/A controller pilot data link communications (CPDLC) over oceans. The U.S. company was awaiting release by the FAA of a Technical Standard Order (TSO) that provides manufacturers with guidance to build approved systems. Meanwhile, Iridium’s previous-generation Short Burst Data (SBD) service, which has supported “FANS-over-Iridium” for a decade, remains available.

“We’re waiting for the conclusion of the TSO with the FAA, and then we will enter FANS trials for aviation safety using Certus,” Last said. We expect FANS [approval] about the end of next year. Once they finish those trials, you will see Certus installed for aviation safety applications on commercial transport aircraft.”

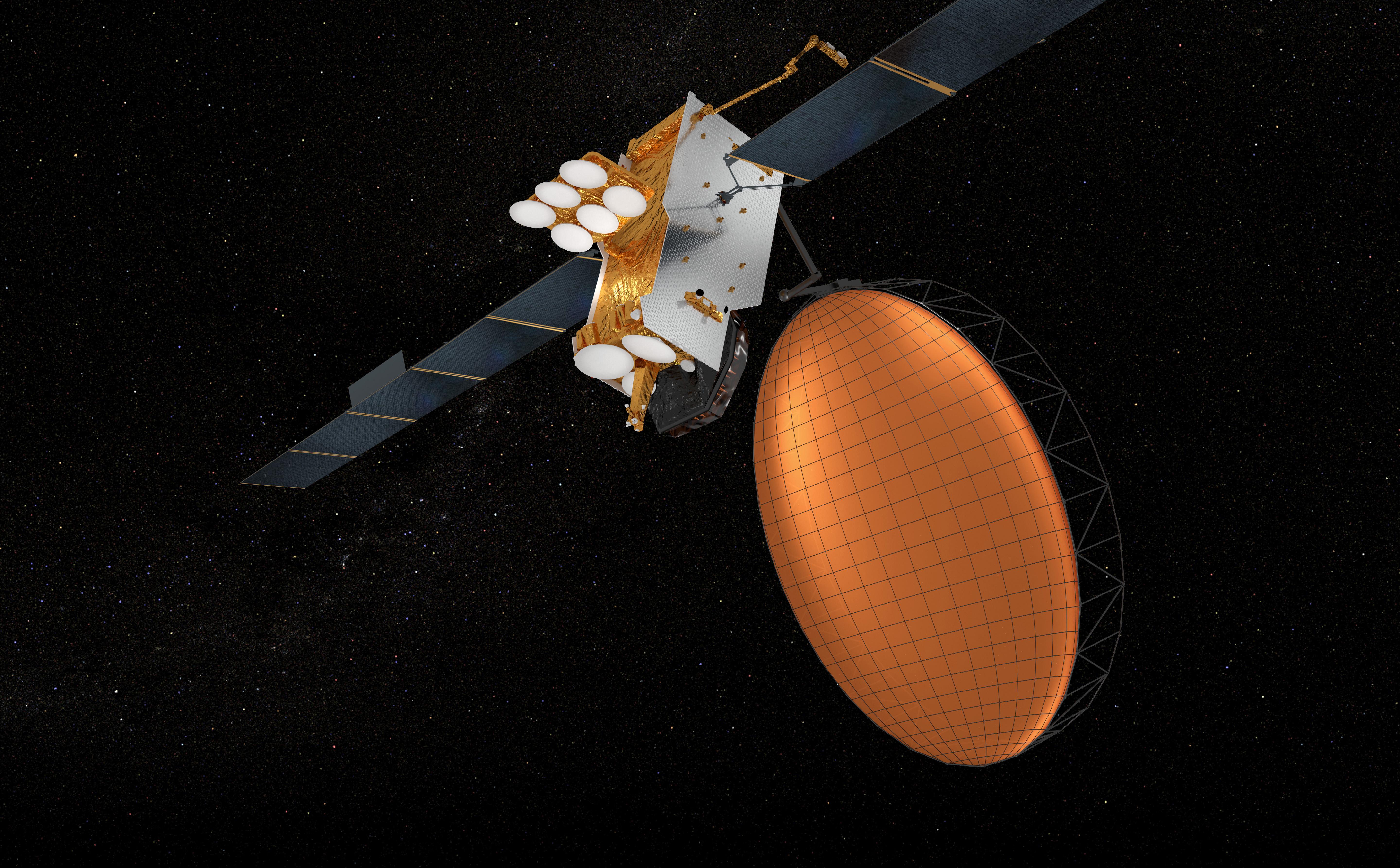

While Iridium reports ongoing progress in developing Certus terminals, Inmarsat on Aug. 12 unveiled Elera, a major upgrade to its L-band network that promises higher data speeds and smaller, lower-cost terminals for aviation users. Inmarsat’s new I-6 dual-payload L- and Ka-band geostationary (GEO) satellites will support existing Inmarsat Classic Aero H+ and SwiftBroadband service while providing L-band connectivity to a broader range of platforms, including drones, urban air mobility vehicles and general aviation aircraft.

Inmarsat received FAA approval of its SwiftBroadband-Safety (SB-S) service for safety-critical air traffic services applications in March 2019. SB-S will also support Europe’s “Iris” data link for CPDLC and 4-D aircraft trajectories, which add a time factor to the dimensions of latitude, longitude and altitude for more-precise flight tracking and “trajectory-based” air traffic management.

In December 2020, the U.K. satellite operator discontinued its Swift64 service—introduced in 2002 as the first “high-speed” data service, offering speeds of 64 kbps-per-channel for flight planning, weather and chart updates, and other applications.

“As we get to these bigger, better [I-6] satellites, it was time to refresh and extend the abilities of our product portfolio and that’s what Elera is really about: how we take the existing BGAN [Broadband Global Area Network]—and in the case of aviation, SwiftBroadband—capabilities and expand them in both the upper end and the lower end,” said Peter Hadinger, Inmarsat chief technology officer.

Inmarsat expects that business aviation operators equipped for SwiftBroadband reception will be the first to acquire Elera service.

“You will see the business aviation market pick this up first,” Hadinger said. “Some of these will be upgrades that can just be done with a ‘flash’ upgrade—you can go in and change the software in the radio and you’re done. For the ones that require a card change to change out the modem, it’s a relatively straightforward process. The intent is, the [equipment] manufacturer will have that ready to go by the time this is up and running at the end of 2022.”

Longer-term plans include qualifying Elera for safety-critical CPDLC connectivity to airline and business jet flight decks.

At least publicly, the satellite operators downplay any challenge they face from each other’s new L-band services. “I like to think of Iridium as still trying to get into our markets,” Hadinger said. “Their Certus introduction has been trying to move up-market in speed to the areas where BGAN has been for decades now…. We accept that challenge and we’ll take it.”

Iridium contends that its legacy of supporting lower-size-and-weight, lower-cost equipment on aircraft, with service coverage that includes polar regions that GEO satellites cannot support, represents a unique value proposition.

“As far as I can tell, it was just a good bit of marketing,” Last said of Inmarsat’s Elera upgrade. “We think the proposition supported by Certus is very solid,” he added. “The nature of Iridium being global, of being generally lower-power, more lightweight, lower-cost than our competitor’s solutions, still holds true. At the moment, it’s not clear [if Elera] is anything else other than simply wrapping up preexisting investments and network plans into a new name.”