Study: How To Accelerate Aviation’s CO2 Reduction

Solving aviation’s climate footprint will be the most significant technological achievement since the beginning of human flight. But to truly tackle the challenge, we will need a holistic approach that looks at the entire chain of sustainable aviation, from the cradle to the grave. The electric car industry vividly shows us how everyone focuses on emissions “at the tailpipe” and forgets about other factors, such as the environmental footprint of mining the raw materials required for manufacturing batteries, as well as the impact generated by the energy production itself, which in most cases is not even accounted for in transportation statistics.

Being holistic also implies that, in a global industry, we must work together at different levels and on different solutions, aiming for the same shared goals. One thing that has already emerged is that electrification and hydrogen might be excellent solutions in the longer term but will not bring any significant leverage in the next 20 years.

Albeit relatively small on the global scale, aviation’s share of global carbon emissions continues to rise. This means the industry cannot wait for technological silver bullets but must double down on efforts to decrease its footprint with measures that can be applied today.

The world has already found common ground on decarbonizing road transport with electric vehicles. We know how to decarbonize energy production via wind, solar and nuclear at a comparable or lower cost than fossil fuels. Decarbonizing industrial processes is at an earlier stage of development but also appears to be a solvable issue from a technical point of view.

Aviation, in contrast, is a tough nut. Aviation’s contribution to the global share of emissions is bound to rise much steeper than the recent growth trajectory suggests.

One field with significant startup activity is hydrogen. The dream of hydrogen being used to store cheap wind and solar energy, and to be employed, for example, in industrial processes, is understandable, and so is the idea to use it for aircraft propulsion. Hydrogen projects are being increasingly well-funded, pushed by the global wave of investments supporting ESG goals. There is growing confidence that we could see the first commercial hydrogen aircraft fly and be certified before 2030. It will then be a sub-100-seat converted turboprop. However, this is different from the segment where mass transportation is concentrated in terms of passengers or cargo. Addressing and solving all three aspects of hydrogen flight, including scaling the ground infrastructure, will take decades. It is plausible that hydrogen will become a solution for aviation in the long run, but not before 2050.

For significant technology changes, ground infrastructure on a global level will need to be adapted, too. Allowing new technology aircraft to be adequately operated takes considerable time. It will be crucial to run things in parallel. Other aspects, such as digitalization and improving air traffic control routings, novel aerodynamics, or lighter airframe materials, will all be complementary, but will not yield a net-zero result.

The industry will add around 20,000 newly built conventional aircraft in the next years. They will consume less energy than the aircraft in service today but will not deliver significant progress toward reaching net-zero emissions and will fly beyond 2050.

Even if the latest aircraft technologies have lowered energy use, it won’t be fast enough to slow down emission growth. To illustrate this: the latest engine technology, which is used on the Airbus A320neo and Boeing 737 MAX, has achieved a 15% reduction in fuel burn and, with this, emissions. This latest engine generation entered the market about 20 years after its predecessors. The stats look a little better for the generation before that, when moving 25 years from the Boeing 727 era to the A320 age resulted in 35% improvement.

Simplified, we have been looking at an average 1% reduction in fuel burn and emissions per year in the past 50 years. But global commercial aviation is projected to grow between 2.5% and 3.5% per year on average, and this will be done with the aircraft generation already in production. Hence, we project to see overall emissions from aviation growing by 1.5%-2.5% per year through the 2020s and 2030s. As climate change accelerates, this poses a real threat to aviation as a sector and to people’s ability to fly.

We believe supporting new technological concepts and chasing dreams is vital to the industry. However, in parallel, the industry needs to change the way it works today and how it can support delivering true zero-emission or at least true carbon-neutral flights with the current technology already. A larger block of financial support into immediate tangible reductions would be helpful.

The SAF Bridge

Sustainable aviation fuel (SAF) can potentially reduce lifecycle emissions by up to 80% compared to conventional aviation fuel. This largely depends on the sustainable feedstock used, the production method, and the supply chain to the airport. SAF was first used by the aviation industry in 2008. According to the IATA, since 2016 more than 370,000 flights have taken off using a SAF contribution.

SAF does not reduce “tailpipe” emissions from burning fuel inflight. The calculated reductions in greenhouse gas emissions come from the life cycle of jet fuel. Consuming conventional jet fuel releases fossil CO2, pulling it from the ground and adding it to the biosphere’s total carbon. Meanwhile, burning SAF returns carbon to the atmosphere that had previously been absorbed by plants or that would have been released as industrial waste gases or household garbage.

The result is a net “well-to-wake” reduction in life-cycle CO2 emissions. This can be as high as 80% for the SAF produced from biomass (e.g., cooking oil). As a result, commercial flights powered by SAF are coined “net-zero,” as opposed to “zero emissions.”

Synthetic fuels produced from captured CO2 and renewable electricity can reach well-to-wake reductions of 100% relative to fossil jet fuel. Some feedstocks even promise to be carbon negative.

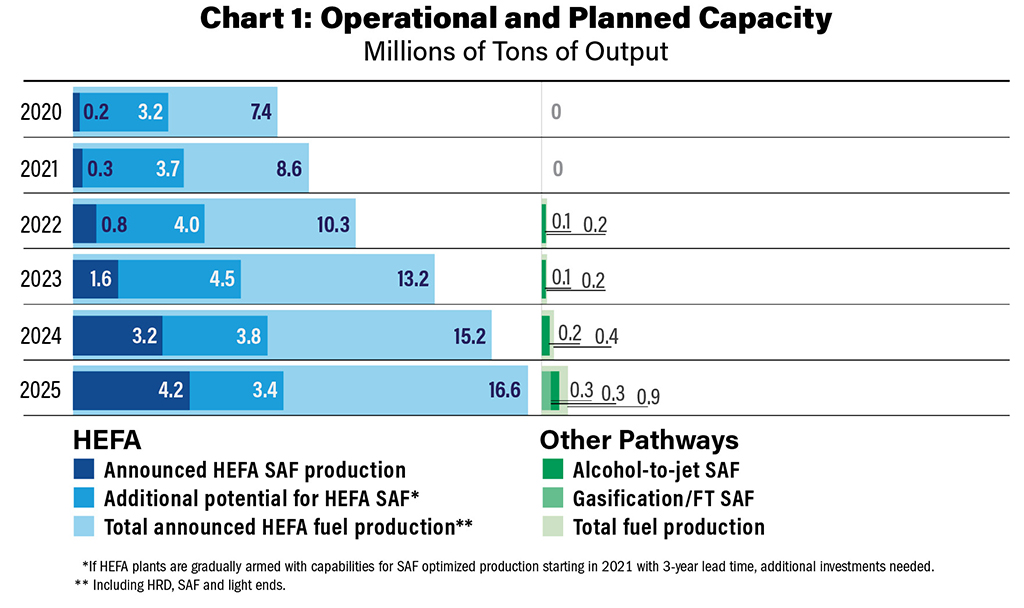

When talking about SAF, it is essential to understand the volumes. The global consumption of jet fuel was around 300 million tons in 2021. The world’s production of SAF was 0.2 million tons; in other words, less than 0.1% of the consumed fuel. Experts think we could reach a share of up to 8% by 2030 if properly talked about and if planned investments are being made. The rampup of the different production methods is also different. Chart 1 shows the expected volume growth between the different SAF production methods.

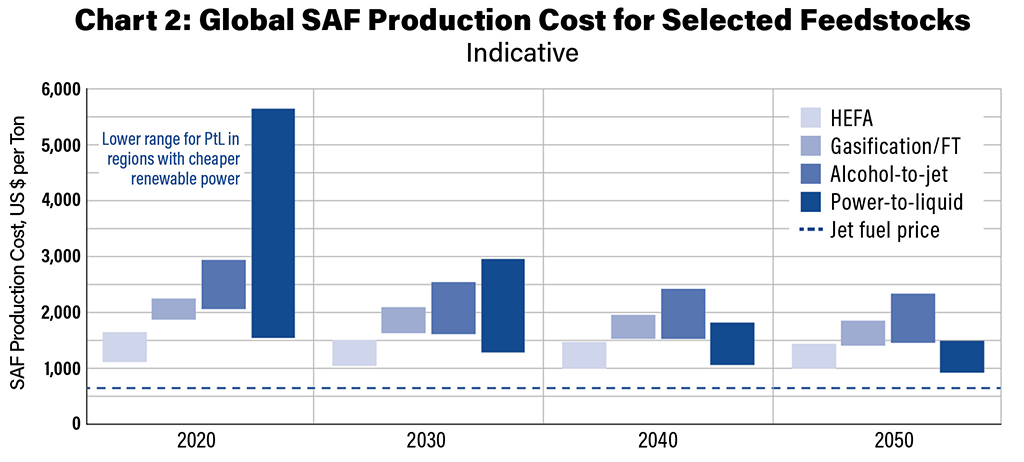

Hydroprocessed esters and fatty acids (HEFA), which refines vegetable oils, waste oils or fats into SAF through a process that uses hydrogen, will dominate SAF production beyond 2030, but then other methods should catch up. It depends on the cost of production, as seen in Chart 2.

To scale SAF production as rapidly as in the chart projections, governments must introduce incentives for investing in production facilities. Increasing quotas of SAF percentages would create such an environment.

Several airlines and manufacturers have set a target to reach a 10% SAF blend level by 2030. Given that production volumes will be challenged to reach 10% of the annual fuel volume, this target will only be achieved with significant uptake and production of sustainable fuels.

We already know how to produce sustainable aviation fuels. It is a question of scaling, not a question of technology.

To increase the share of SAF as efficiently as possible, we will have to concentrate on the most mature method first, which is HEFA, and work to mature the others as quickly as possible. This means that SAF will remain a field of utmost relevance both politically and investment-wise.

Today, SAF production cost is, on average, between two and four times the cost of conventional fuel. Government support and incentives will be required until the industry matures and production costs drop. The same goes for an emissions tax. It is perhaps the most vital step in the chain, but one that airlines and airports cannot address on the free market without losing all competitiveness. Within Europe, it is an issue that needs to be discussed on the transnational level to generate an impact. On the production side, the major challenge is mobilizing investments to develop multiple new large-scale facilities to increase SAF production so that additional demand can be met and costs are reduced.

New Turboprops

In the late 1990s, we saw regional jets killing most of the demand for turboprops despite their economic advantages and despite turboprop aircraft becoming more comfortable for passengers since then. In the last 15 years, we saw another shift toward larger jets with lower seat-mile costs (except on US routes where scope clauses still apply). But these larger aircraft need partly induced demand to fill them and to operate in economically viable ways.

This leaves us with a very limited market for turboprops today regarding availability and seats. With the comfort levels that modern turboprops can offer and potential faster travel times for distances up to 600 km because of more optimal flight routes, there is an obvious benefit in building new turboprop designs with the most modern conventional engines and larger seat capacity, drastically reducing emissions compared to the smallest jets. And a turboprop of similar technology will beat a jet by 20%-30% in consumption and emissions, thus making it more economically viable than a comparably sized jet when looking at efficiencies per passenger or per passenger/km. Replacing anti-economic jets with turboprops on regional and short-haul routes is a target achievable by the middle of this decade. Moreover, these aircraft can also operate with SAF, reducing emissions even further.

Retire Older Aircraft

It should not be economical to fly old and inefficient airplanes simply because they are already written off financially. Without a global carbon tax, governments should limit fuel consumption per seat mile, forcing older planes out of the skies. The same should happen with freighters. We suggest limiting standards in carbon emissions per ton of freight.

The bulk of active commercial aircraft remains in the narrowbody category—specifically, the Airbus A320 and Boeing 737 families. While the consolidation of air traffic during the pandemic has already ensured that the oldest “hogs” in global aviation are no longer flying, even between the two latest generations of the best-selling single-aisle aircraft, there is a difference in fuel consumption per seat kilometer of up to 20%. Further incentivizing airlines over several years to switch from their A320ceo/737NG fleets to neo/MAX aircraft could have a sizeable impact on overall emissions. The same applies to moving out older long-haul generations like the A330 classic, A340s and Boeing 767s. If you think this is far-fetched, it is precisely what the German government introduced in the automobile sector during the financial crisis of 2008/09 (and again recently with electric vehicles), where citizens were nudged to replace their old cars with more modern versions requiring less energy/fuel.

One Industry Voice

Historically, the aviation industry has yet to be successful in speaking with one voice. Despite institutions like IATA, different stakeholders have focused primarily on their own agendas. For a real uptick in decarbonization efforts, we must create a more open and hands-on mentality where airlines, airports, fuel providers and manufacturers work together closely and visibly for the same goal globally.

Aside from longer-term technologies like hydrogen, more R&D has to be directed toward lowering the production costs of SAF and ways to scale production efficiently. It is the most effective solution for the next 20 years, and research activity and funding should reflect this. In these areas, there is still much potential to be unlocked in the next two decades.

An unclear regulatory situation is one of the reasons why investment into SAF is still relatively slow. In short: In many cases, we don’t know which kind of SAF and which type of production method will qualify for a “sustainable” label by authorities and regulators. This “limbo” situation slows innovation and must be solved quickly. A global certificate and framework system is required now to avoid spending billions on technical research and production plants without achieving the promised global impact in the required timeframe. Capital will only be available for technologies with the stamp of approval to yield future benefits.

We hope that in the second half of the 21st century, we will see aviation overcome the next frontier, with technologies like hydrogen or fuel cells becoming mainstream for all aircraft sizes and ranges.

Yet we believe it is our responsibility today to accelerate a drastic reduction in CO2 emissions and make a joint effort to implement the maximum reduction of aviation’s greenhouse gas emissions with the limitations of physics as they apply today.

We are confident that the three pathways can be implemented quickly and that we have enough opportunities to reduce emissions effectively until 2050. Let us start bridging the gap today. We have the ingredients already.

About the authors: Nico Buchholz has over 30 years of international experience, mainly in the airline and aerospace industries; Bjorn Fehrm is an airliner analyst at Leeham Co.; Lukas Kaestner is a co-founder and CCO at the Sustainable Aero Lab; Stephan Uhrenbacher is an entrepreneur who has founded internet companies such as Qype and 9flats; Mario Vesco is venture manager at the Sustainable Aero Lab. The full report can be found at www.sustainable.aero.