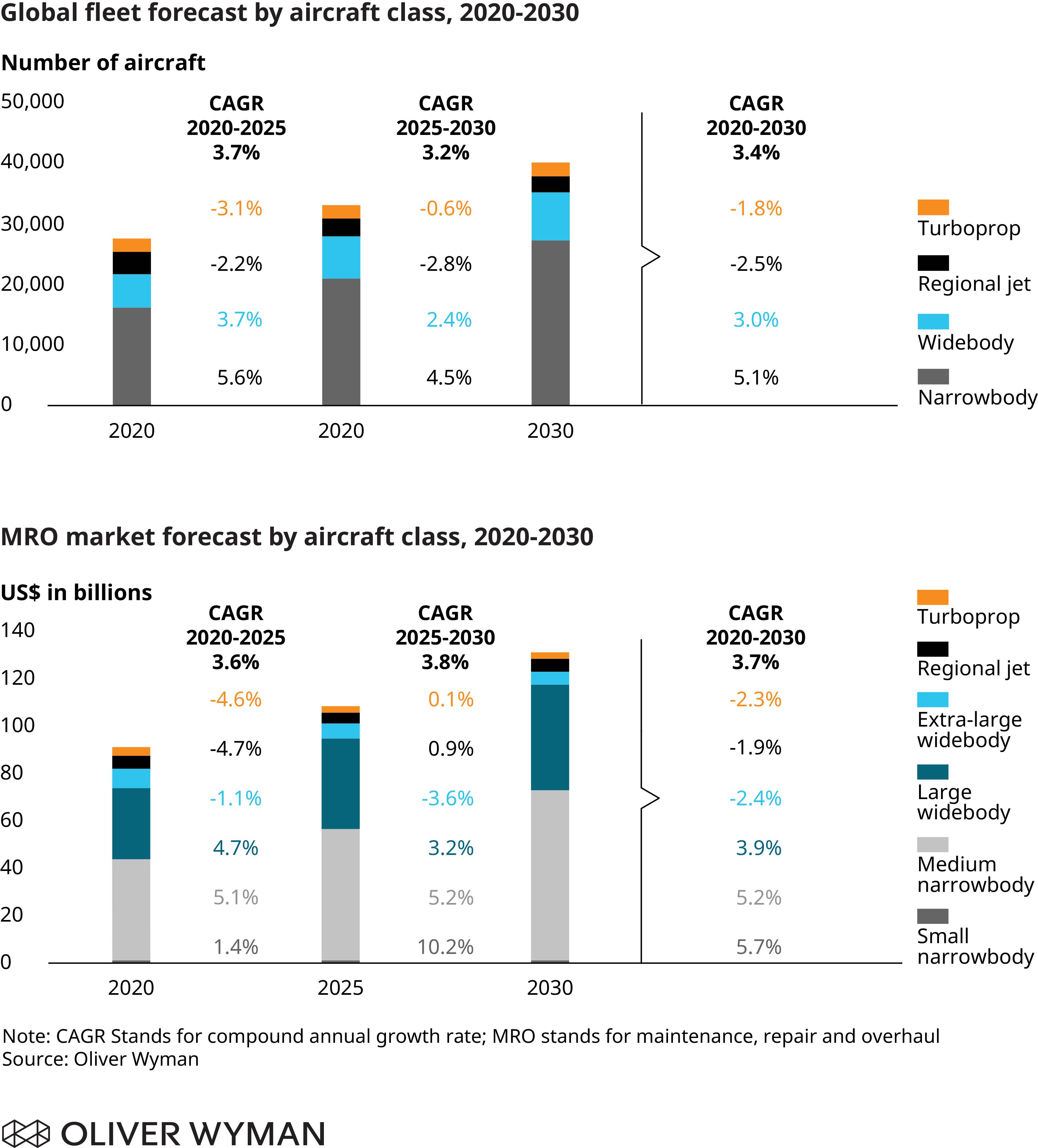

While the COVID-19 virus, Boeing 737 MAX groundings and trade issues are negatively impacting air travel, the outlook for commercial aviation fleet and MRO growth over the next decade is very healthy. Expect manufacturers to deliver more than 21,000 aircraft, which represents a 30% production increase over the last decade, according to Oliver Wyman’s Global Fleet & MRO Forecast released Feb. 12. Expect MRO demand to grow from $90 billion in 2020 to $130 billion in 2030, which is a 3.7% annual growth rate, says Tom Cooper, an Oliver Wyman vice president and lead author of the annual report.

In what seems a bit counterintuitive, the global fleet is older than before, as airlines retain mature aircraft longer than anticipated to weather the new aircraft production program problems, but aircraft retirements are rising, and will continue to do some over the decade.

The percentage of the fleet that is 25 years or older, the typical age for a retirement candidate, is increasing, and as new aircraft production ramps up over the coming years, “the overall share of the fleet that starts to get into a typical retirement window will increase fairly significantly,” says Cooper.

A larger number of aircraft retirements should have a positive impact on the used serviceable material market, but Cooper cautions that more of the parts shortages are a result of OEMs struggling to support new and mature platforms.

Related to retirements, Oliver Wyman sees a trend toward increasing flight hours to flight cycles ratios. Cooper points to a trend away from older turboprops and regional jets, which have a shorter range. As airlines upgauge these aircraft with ones with longer range, expect the flight hours to cycle ratio to increase so “aircraft that will retire in the future will do so with more hours and cycles,” he says.

Oliver Wyman’s report shows that there are 2.5 times more aircraft 25 years or older in service now than there were 10 years ago.

While the return to service date for the 737 MAX, grounded in March 2019, remains unclear, it could reenter service sometime this year. Whenever the 387 previously in-service aircraft and about 400 built, but not delivered, aircraft are cleared—Cooper expects to see a “fairly repaid return to service.” If that happens, “you’ll see a ripple in demand for airframe visits down the road and a pent-up demand for the normal cycle of reliability improvements that you see with any new aircraft introduction,” he says. On a more macro scale, Oliver Wyman expects the MAX to get back on track and operate for many years, which means after the grounding is over and production ramps back up, the “whole MRO demand curve for the MAX just shifts one to two years,” says Cooper.